A full audit of the US Federal Reserve has revealed that it provided a staggering $16 trillion in loans to bail out American and foreign banks and corporates during the worst economic crisis since the Great Depression. One of the biggest benefactors of the bailout was Wall Street - the same Wall Street that is now calling for cuts to social spending.

A full audit of the US Federal Reserve has revealed that it provided a staggering $16 trillion in loans to bail out American and foreign banks and corporates during the worst economic crisis since the Great Depression. One of the biggest benefactors of the bailout was Wall Street - the same Wall Street that is now calling for cuts to social spending.As the United States heads towards a possible debt default on August 2, its gone largely unnoticed in the corporate media that the first comprehensive audit of the Federal Reserve has uncovered monstrous new details about how the Federal Reserve provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression.

The report was released just over a week ago.

The biggest benefactor of the massive bailout was , no prizes for guessing, Wall Street.

The investigation revealed that the Federal Reserve contracted out nearly all of its emergency lending programs to the denizens of Wall Street including JP Morgan Chase , Morgan Stanley and Wells Fargo. Morgan Stanley was given the largest no-bid contract worth $108.4 million to help manage the Federal Reserve bailout of AIG.

If this wasn't enough, these very same firms received trillions of dollars in Federal Reserve loans at near-zero interest rates. Meanwhile, all across the America, ordinary folk were losing their jobs and their homes - and still are.

Stunningly,the Federal Reserve provided conflict of interest waivers to employees and private contractors so they could keep investments in the same financial institutions and corporations that were given emergency loans!

For example, the CEO of JP Morgan, Jamie Dimon, sat on the Federal Reserve's board of directors at the same time that his bank received more than $390 billion in financial assistance from the Federal Reserve Bank. If that wasn't enough, JP Morgan served as one of the clearing banks for the Fed's emergency lending programs!

None of this has provoked any outrage from the corporate media, seemingly transfixed by the machinations going on in Congress.

Jamie Dimon, whooping it up in big vat of Federal Reserve cash, is now urging White House and Congress to make a debt deal, which would see social service and welfare budgets slashed.

Dimon said this week that a debt default would ''dramatically worsen our nation's already difficult economic circumstances'.

Of course it was Jamie Dimon and Wall Street that created these 'difficult economic circumstances' in the first place

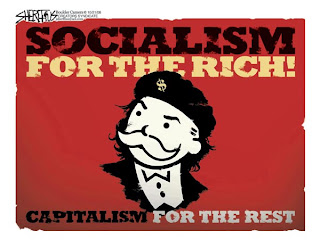

Sen. Bernie Sanders, who headed the audit. said in a statement that 'This is a clear case of socialism for the rich and rugged, you’re-on-your-own individualism for everyone else.'

0 comments:

Post a Comment

Comments are moderated.